Tax and Finance Hyperautomation

Hiperautomação, Robotização Tributária e Financeira

Recuperação e otimização de tributos, portal de compras, portal do fornecedor e portal de entradas fiscais e não fiscais, com contas a pagar e integração direta no seu ERP.

The Solutions Ecosystem That

Puts You in Control of Tax Reform

Assess the impacts of the Reform, transform critical processes, optimize

tax credits, and prepare your business for a winning tax future.

The Clock Is Ticking!

Tax Reform

takes effect

on January 1, 2026.

Why is this the decisive

moment for

Tax Reform?

93%

of medium and large companies will be impacted.

90%

of ERPs will not meet the new requirements.

Companies that wait until 2026 will fall behind.

Those who act now will gain full control and avoid costly setbacks.

These companies are already leading the Tax Reform transition.

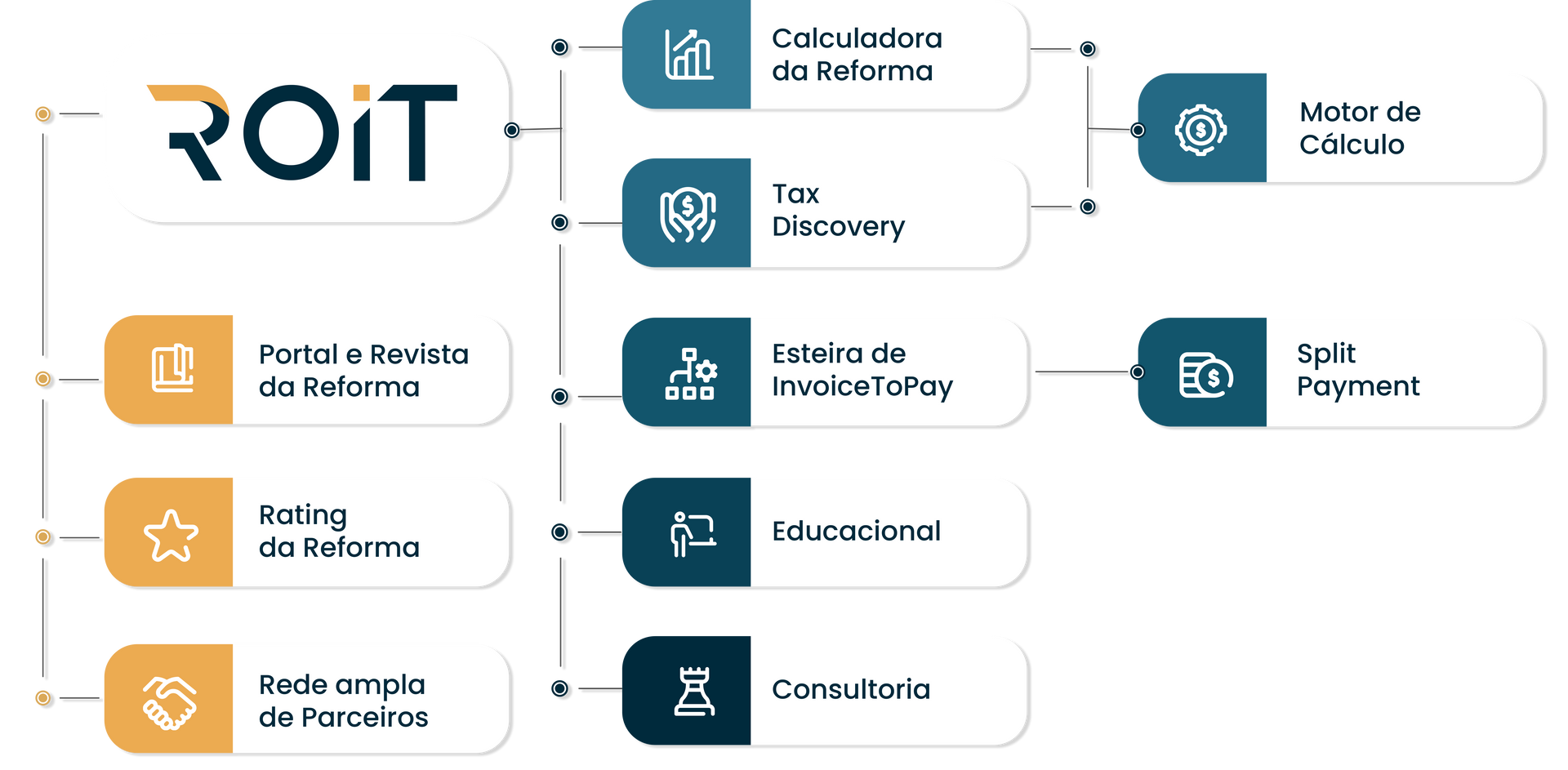

Our Solutions

A Unified Ecosystem for Compliance and Performance

High Technology and Tax AI

Simplify your fiscal and financial management with cutting-edge technology and gain total control over the changes brought by Tax Reform.

Calculadora Oficial

Official Tax Reform Calculator

The only Official Calculator on the market

Evaluate the Tax Reform’s impact on your company with precision.

Our high-tech solution uses Artificial Intelligence to reprocess SPED and Invoice data, recomposing all tax bases to calculate the exact effects of the Reform.

Choose the tool that delivers reliable results and maximum efficiency, eliminating the risks of incomplete or inaccurate assessments.

Assine nossa newsletter e acompanhe o mercado de tecnologia e Hiperautomação em Tax & Finance

Esteja sempre um passo à frente. Assine nossa newsletter e fique por dentro das tendências e novidades do mercado, eventos, aparições na imprensa e conteúdos exclusivos para as áreas de compras, fiscal, contábil e financeira.