Census cross-checking like you've never seen before

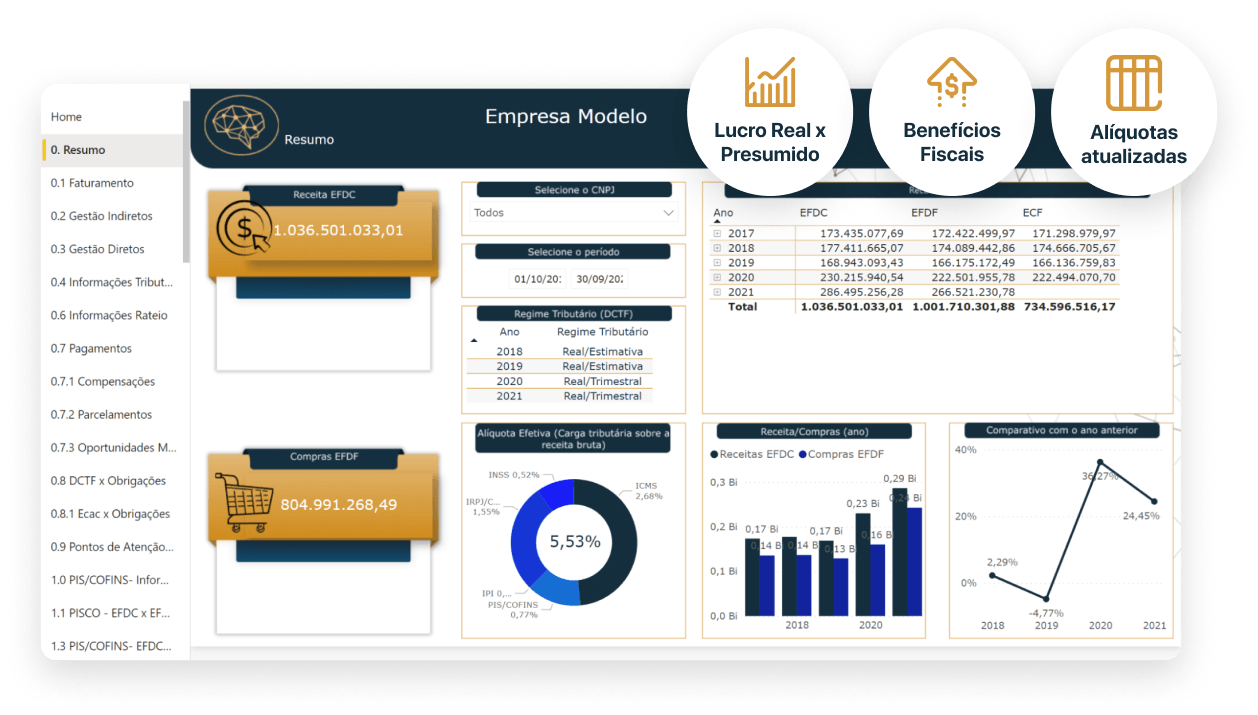

Your company may have been through various tax consultancies, but only with Tax Deep Discovery is it possible to cross-check items,

critique calculation bases and compare rates applied over the last 60 months, from our exclusive database of more than 2.1 billion tax scenarios.

Full Analysis

5-year tax review: PIS, COFINS, ICMS, IPI, ISS, INSS, IRPJ and CSLL directly from accessory obligations and incoming and outgoing invoices, without involvement and tasks for your team.

We care for everything.

Risks and Planning

We present the risks (A, B+, B- e C), with the probabilities of success per tax opportunity, so that the best ways and choices can be discussed with our team of tax experts, in a safe and fast manner.

Operationalization

We present the risks (A, B+, B- e C), with the probabilities of success per tax opportunity, so that the best ways and choices can be discussed with our team of tax experts, in a safe and fast manner.

Monitoring

With so much complexity, it is not difficult that your accounting or even your systems end up getting something wrong. With Tax Deep Discovery, you can monthly monitor more than 90 dashboards with tax information and analysis.

Past tax recoveries do not guarantee future optimizations and recoveries

How Brazil works

We have 50 tax rules, on average, issued per business day in Brazil, according to IBPT. This means that your company may have an ERP (management software) full of incorrect or "expired" tax parameterizations.

Your accounting and tax team may be the best and largest on the planet, but it will never be able to update and criticize all operations, invoices, items, entries and, of course, the delivery of ancillary obligations to the tax authorities. Besides following the ECAC, answering administrative and even judicial demands.

How does Tax Deep Discovery solve this horror show?

In more than 10 years doing tax consulting, even with tax geniuses, we learned that nothing was really enough, the TAX AUTHORITIES were always 10 steps ahead, for one reason: technology.

But today it is not only technology that solves the taxpayer's life, we need more than that. That's why

Tax Deep Discovery automatically combines the monitoring, search, reading, interpretation and censored analysis of the legislation on a monthly basis; with the accessory obligations delivered by your company, the invoices, items and, of course, payments and accounting movements.

The result?

Fiscal compliance and the

lowest tax burden in all operations, not only in Sales, but also in Purchases with suppliers. And, of course, it is possible to recover what was unduly paid in the last 5 years.

Create the best tax strategies

It is much more than the simple crossing of accessory obligations and goes beyond everything that is possible only with the knowledge of the best tax specialists

Receive powerful insights for a successful tax planning

Lista de serviços

-

Identification of tax benefits and incentives Escreva uma descrição para este item da lista e inclua informações de interesse dos visitantes do site. Por exemplo, você pode descrever a experiência de um membro da equipe, o que torna um produto especial, ou um serviço exclusivo que você oferece.

Item de lista 1 -

Automatic simulations for goods and services Escreva uma descrição para este item da lista e inclua informações de interesse dos visitantes do site. Por exemplo, você pode descrever a experiência de um membro da equipe, o que torna um produto especial, ou um serviço exclusivo que você oferece.

Item de lista 2 -

Analysis per tax, per transaction and combined Escreva uma descrição para este item da lista e inclua informações de interesse dos visitantes do site. Por exemplo, você pode descrever a experiência de um membro da equipe, o que torna um produto especial, ou um serviço exclusivo que você oferece.

Item de lista 3

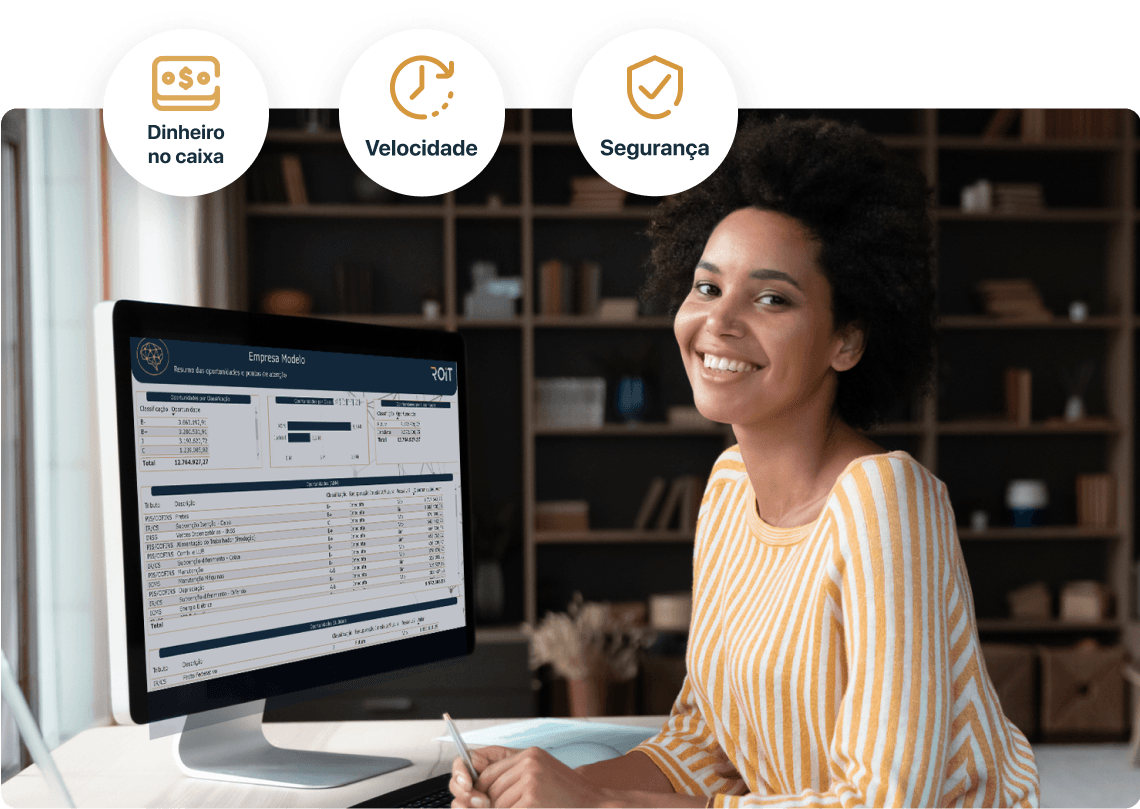

Put a lot of money in your company's box, quickly and safely

Lista de serviços

-

Identification and ranking of opportunities Escreva uma descrição para este item da lista e inclua informações de interesse dos visitantes do site. Por exemplo, você pode descrever a experiência de um membro da equipe, o que torna um produto especial, ou um serviço exclusivo que você oferece.

Item de lista 1 -

Full view for safe decision making Escreva uma descrição para este item da lista e inclua informações de interesse dos visitantes do site. Por exemplo, você pode descrever a experiência de um membro da equipe, o que torna um produto especial, ou um serviço exclusivo que você oferece.

Item de lista 2 -

Full rectification and operationalization of credits Escreva uma descrição para este item da lista e inclua informações de interesse dos visitantes do site. Por exemplo, você pode descrever a experiência de um membro da equipe, o que torna um produto especial, ou um serviço exclusivo que você oferece.

Item de lista 3

EFFICIENT TAX MANAGEMENT

Turn challenges into opportunities

With over 2.1 billion tax scenarios available, manual processes become humanly impossible to run error-free.

That is why AI and Robotization help companies overcome the biggest challenges in Brazilian tax management.

Robotization and Tax Compliance

Temos a maior base de cenários tributários do mundo

+2,1 billion

Of tax scenarios mapped

R$ 1 bi

Already returned to our clients' cash

2 hours

Average time to download and crosscheck all obligations and taxes paid in the last 5 years

It's so impressive it's even made the news

"By using Artificial Intelligence modeling and other technological solutions, the company attacks historical bottlenecks in the segment. With AI and robotization, ROIT simply automates every possible operation."

"ROIT received the Europe Business Assembly's Best Company award thanks to a conveyor belt that reverses the traditional flow of companies in accounting, assessing taxes and paying suppliers."

Sound too good to be true?

Watch the video of our CEO, Lucas Ribeiro, and follow in PRACTICE how the use of Robotization and Artificial Intelligence, coupled with the Human Intelligence of our Tax Consulting, can help you recover amounts never before imagined.

Still don't believe? Request a diagnosis.

Start your company's tax transformation

Let's apply Tax Deep Discovery?

Artificial Intelligence, Robotization and our human expertise explore previously unknown tax opportunities for your company.

Identify and recover taxes that no one else has found.

Talk to an expert now.